Freestone County Appraisal District Property Search

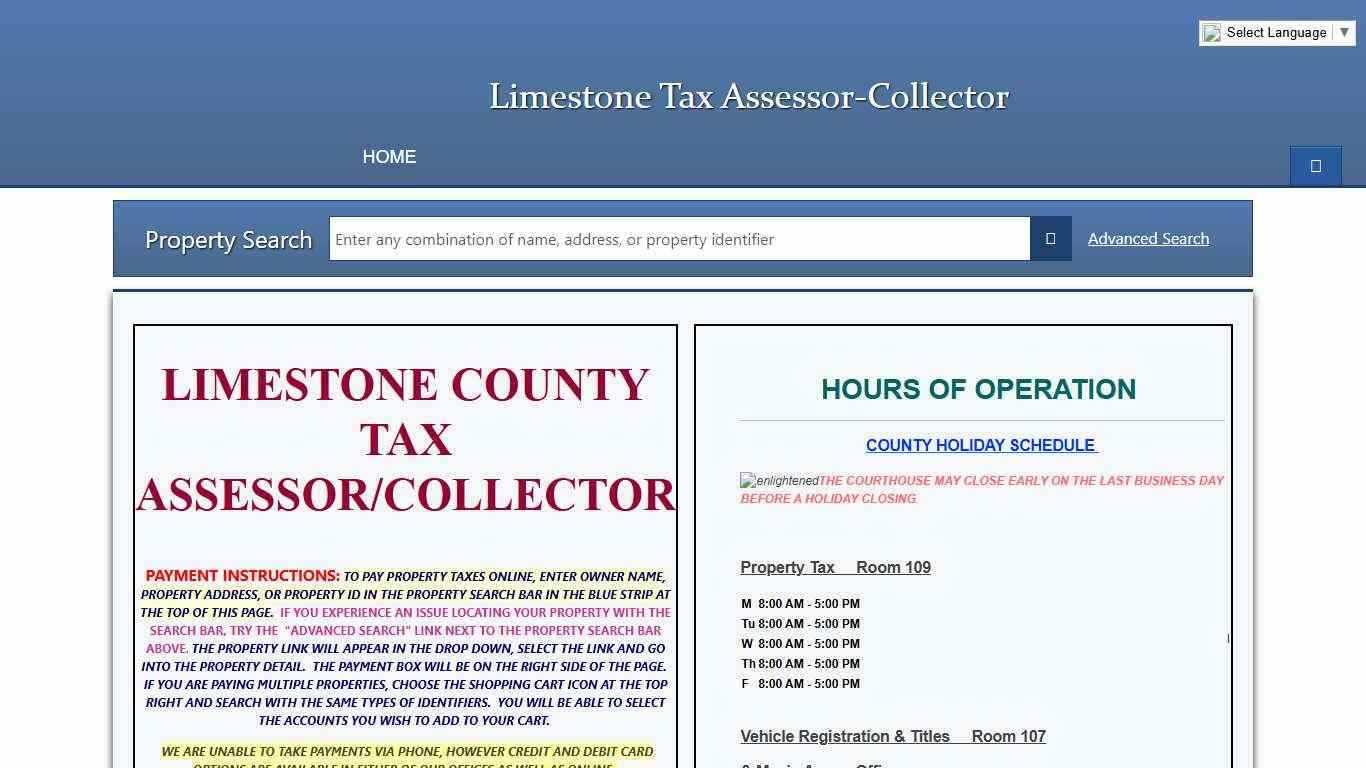

Freestone Central Appraisal District

Within this site you will find general information about the district and the ad valorem property tax system in Texas, as well as information regarding specific properties within the district. Freestone Central Appraisal District is responsible for the fair market appraisal of properties within each of the following taxing entities: The duties of the appraisal district include: - The determination of market value of taxable property - The admi...

https://www.freestonecad.org/

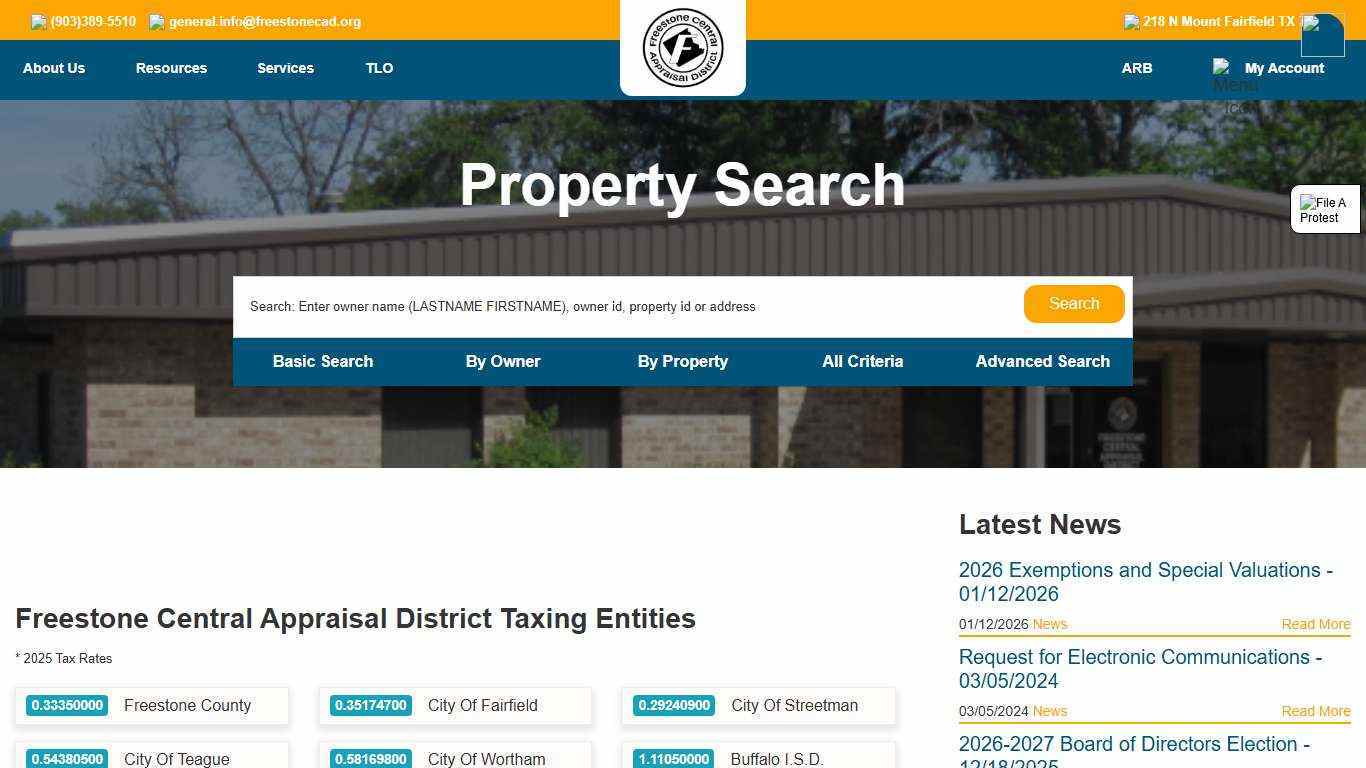

Freestone County Tax Office

Follow the instructions below to register to receive notifications regarding updates to the property tax database: A property owner may register to receive email notifications regarding updates to the property tax database by going to https://www.texastaxtransparency.com/Freestone/ typing in their email address and clicking the “Subscribe” button located at the bottom of the main page.

https://www.freestonetax.org/

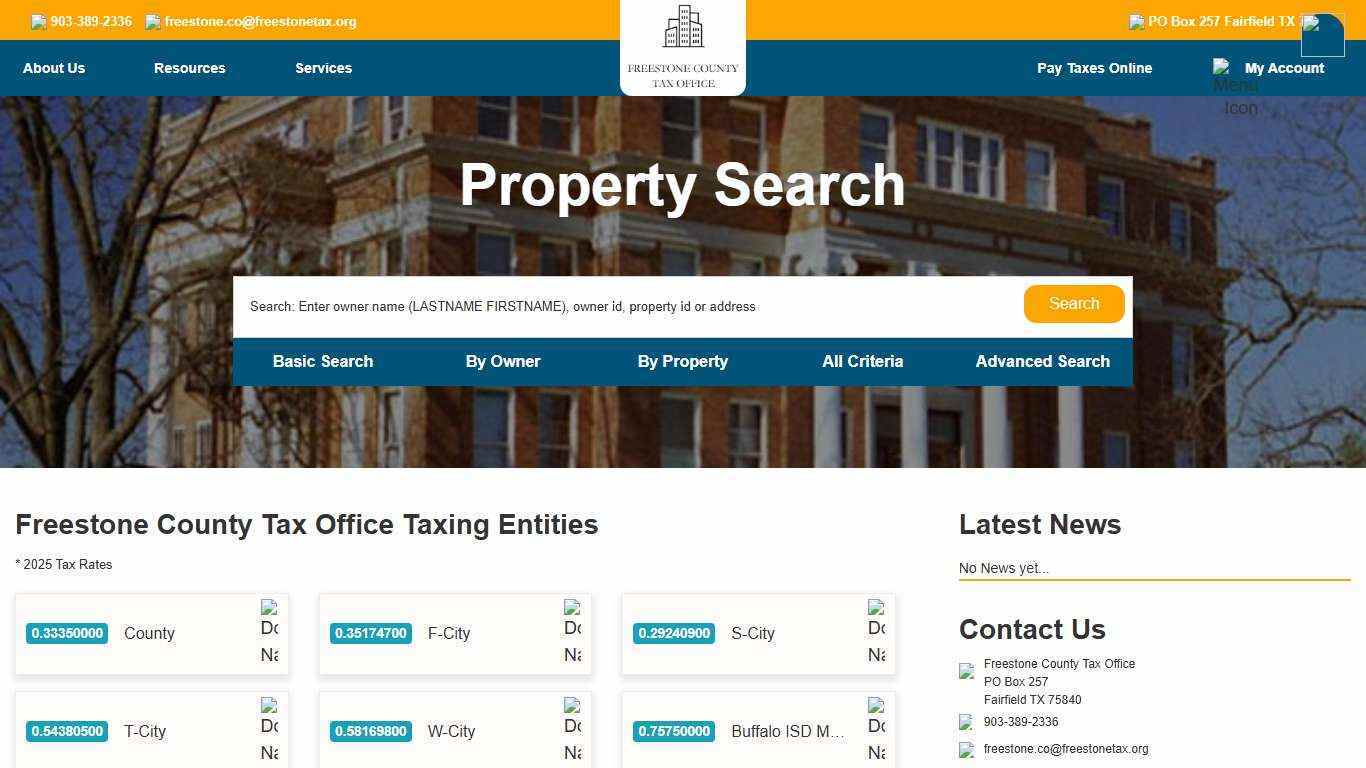

Freestone County, TX Property Search & Interactive GIS Map

Freestone County, TX Property Search & Interactive GIS Map Property Data Search - Freestone County Appraisal District (FCAD) Search Freestone County, TX property records by Owner Name, Account Number, or Street Address. Pro members in Freestone County, TX can access Advanced Search criteria and the Interactive GIS Map.

https://www.taxnetusa.com/texas/freestone/

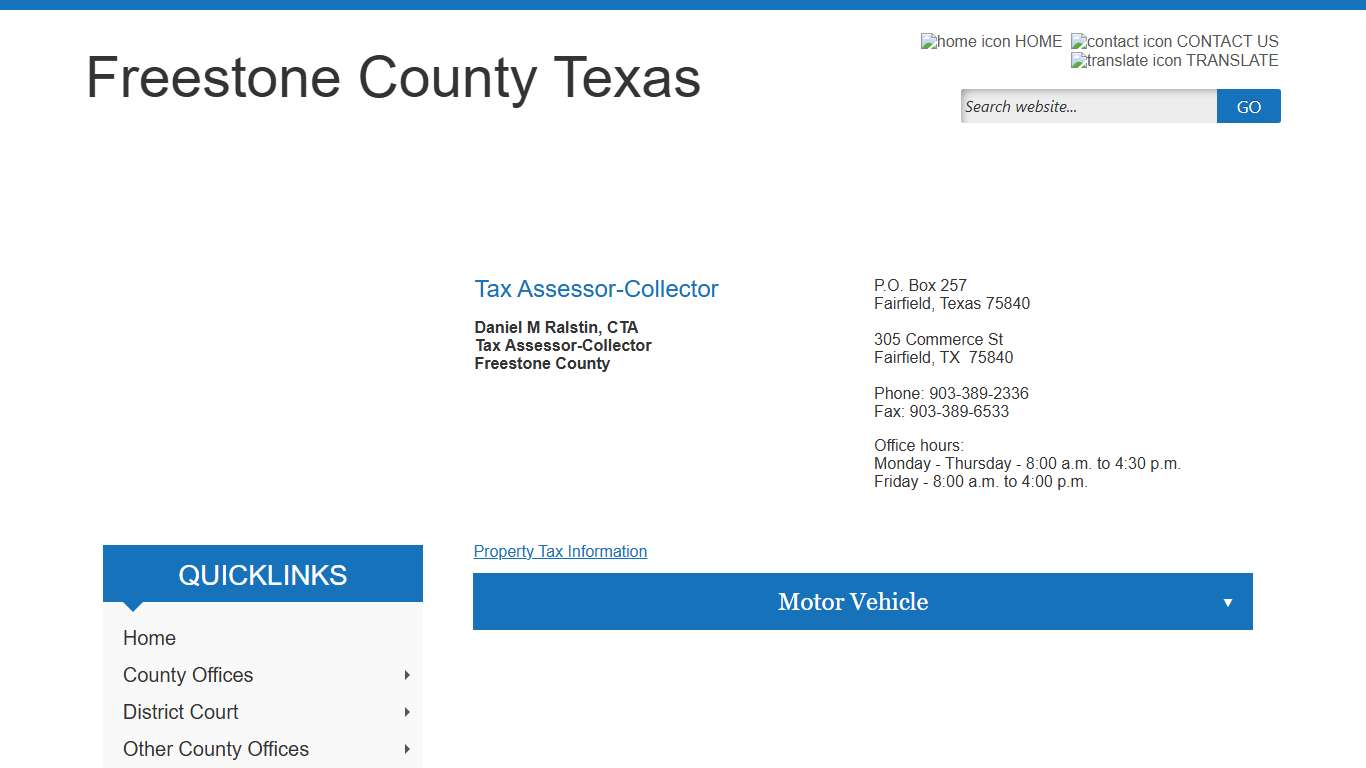

Freestone County, Texas

Daniel M Ralstin, CTA Tax Assessor-Collector Freestone County...

https://www.co.freestone.tx.us/page/freestone.county.assessor.collector

Local Property Appraisal and Tax Information

The Comptroller's office does not have access to your local property appraisal or tax information. Most questions about property appraisal or property tax should be addressed to your county's appraisal district or tax assessor-collector. Appraisal districts can answer questions about: County tax assessor-collector offices can answer questions for the taxing units they serve about: Questions about a taxing unit that is not listed as consolidate...

https://comptroller.texas.gov/taxes/property-tax/county-directory/

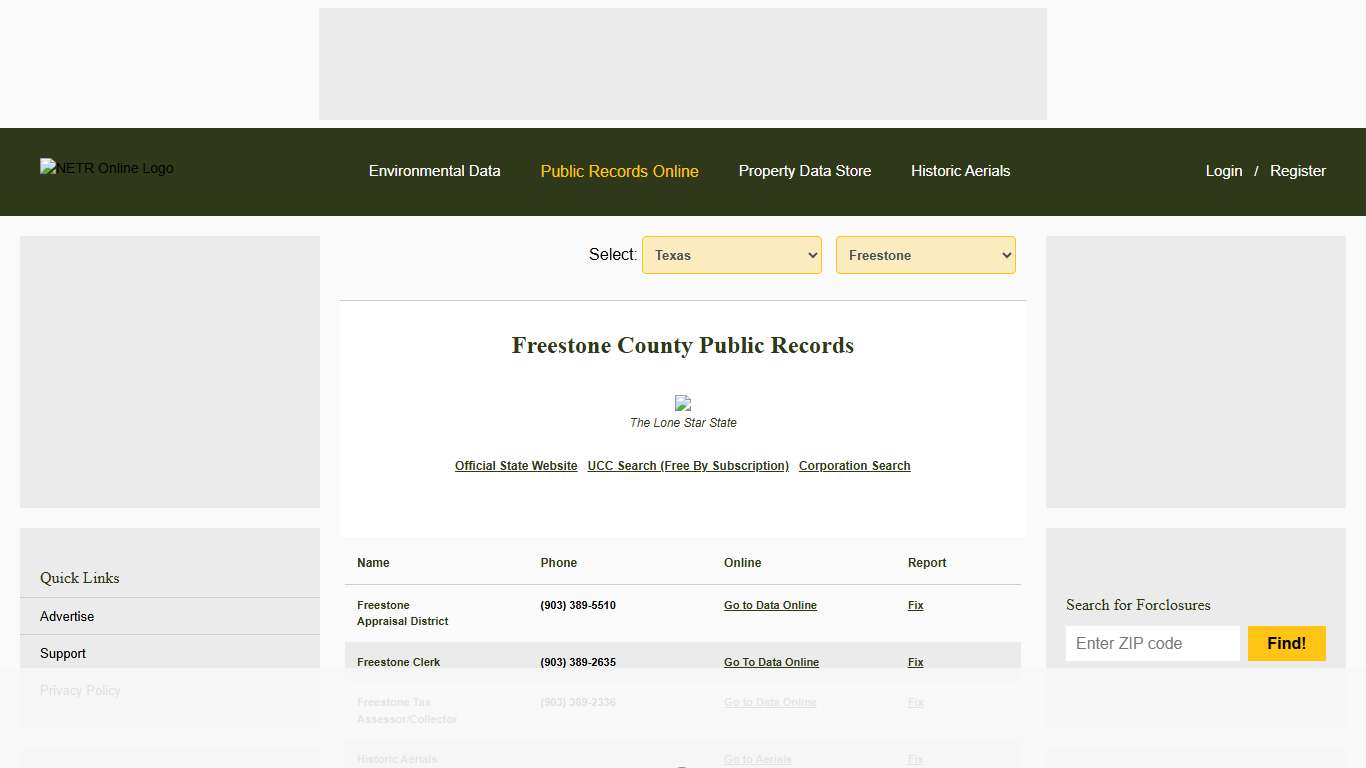

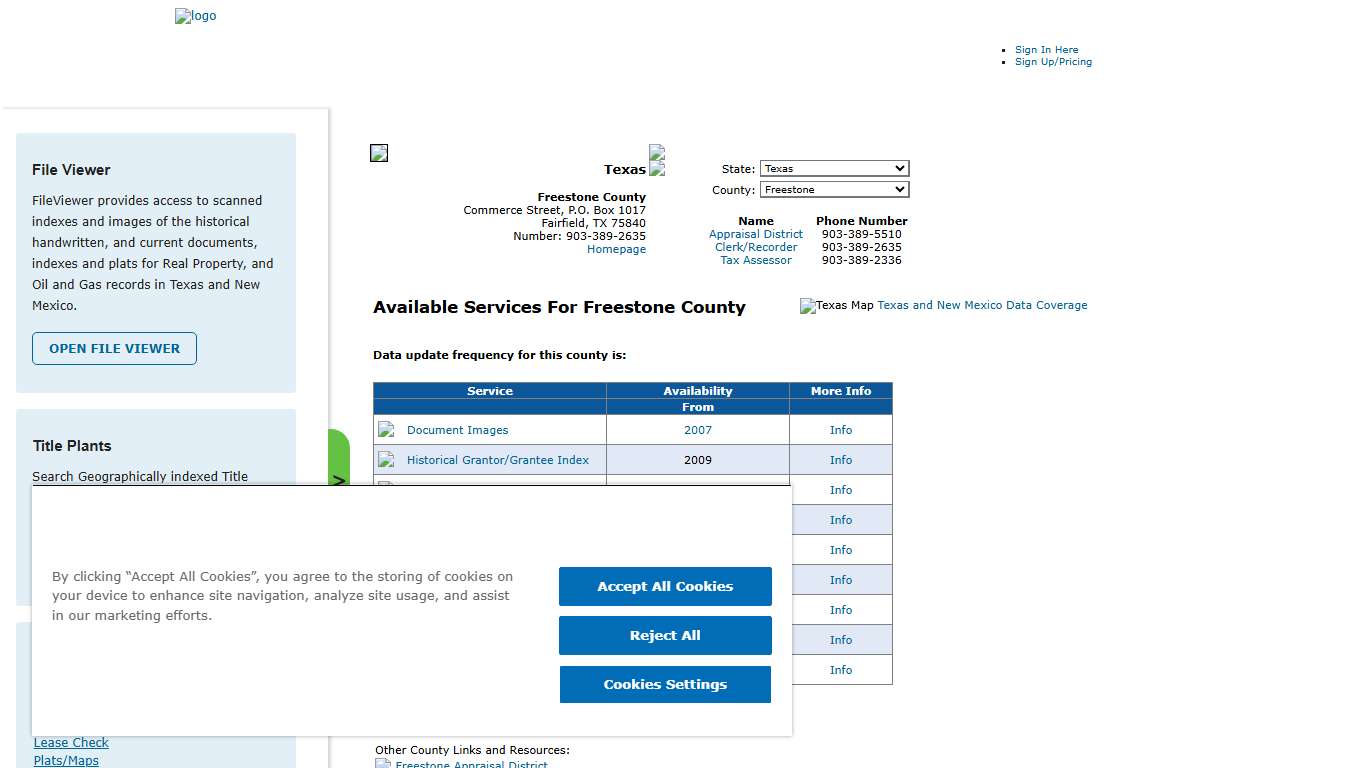

NETR Online • Freestone • Freestone Public Records, Search Freestone Records, Freestone Property Tax, Texas Property Search, Texas Assessor

Select: Freestone County Public Records The Lone Star State Freestone Appraisal District (903) 389-5510 Freestone Clerk (903) 389-2635 Freestone Tax Assessor/Collector (903) 389-2336 Freestone NETR Mapping and GIS Help us keep this directory a great place for public records information. Submit New Link Products available in the Property Data Store...

https://publicrecords.netronline.com/state/TX/county/freestone

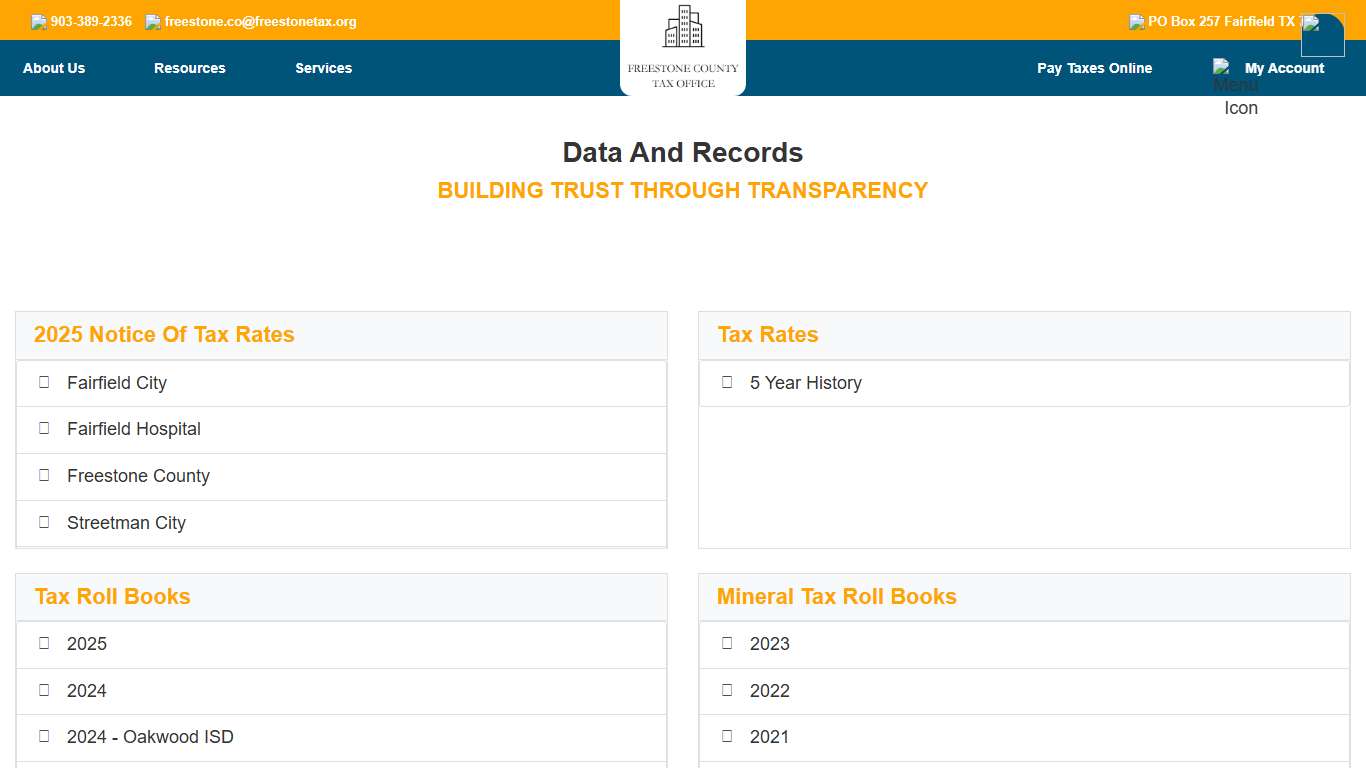

Freestone County Tax Office

Archived Tax Rate Calculation Worksheets...

https://www.freestonetax.org/home/DataRecords

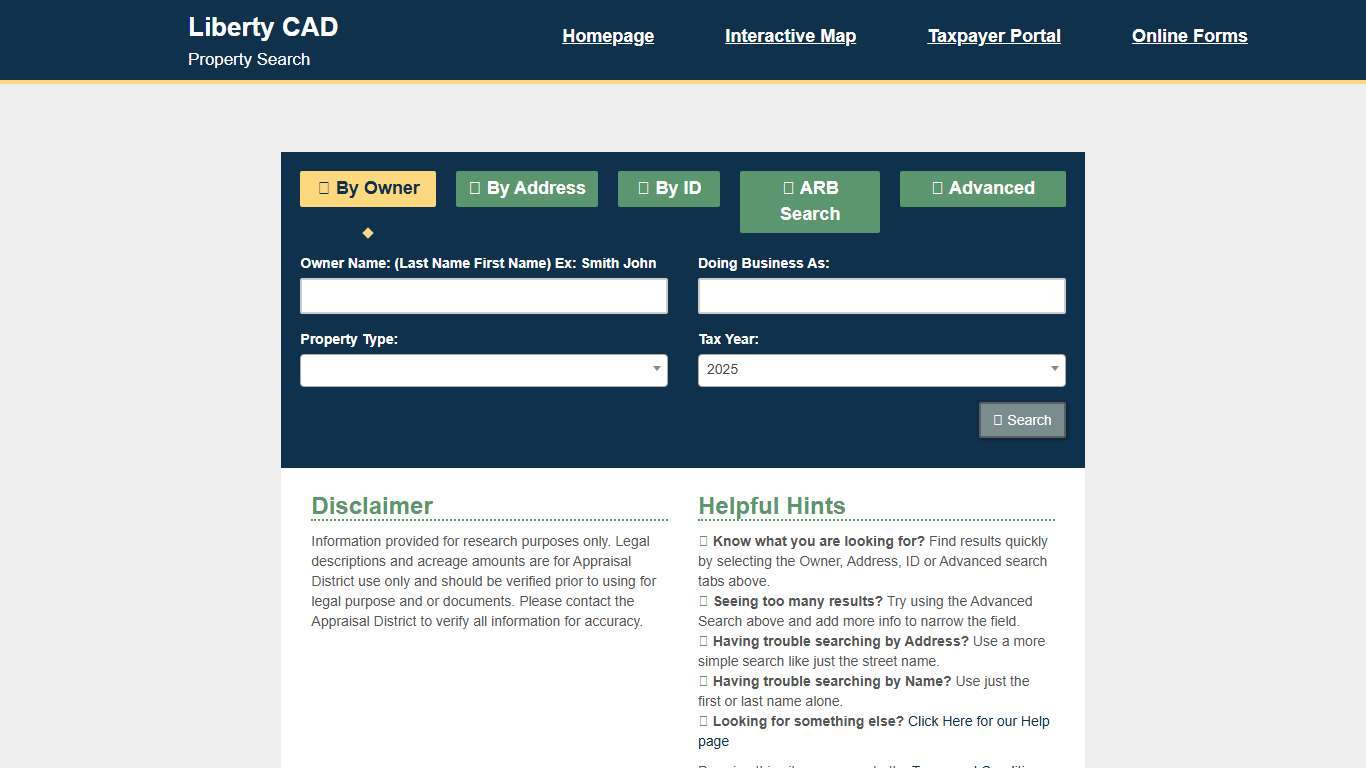

Liberty CAD Property Search

Information provided for research purposes only. Legal descriptions and acreage amounts are for Appraisal District use only and should be verified prior to using for legal purpose and or documents. Please contact the Appraisal District to verify all information for accuracy.

https://esearch.libertycad.com/

Search Freestone County Public Property Records Online | CourthouseDirect.com

These cookies enable the website to provide enhanced functionality and personalisation. They may be set by us or by third party providers whose services we have added to our pages. If you do not allow these cookies then some or all of these services may not function properly.

https://www.courthousedirect.com/PropertySearch/Texas/Freestone

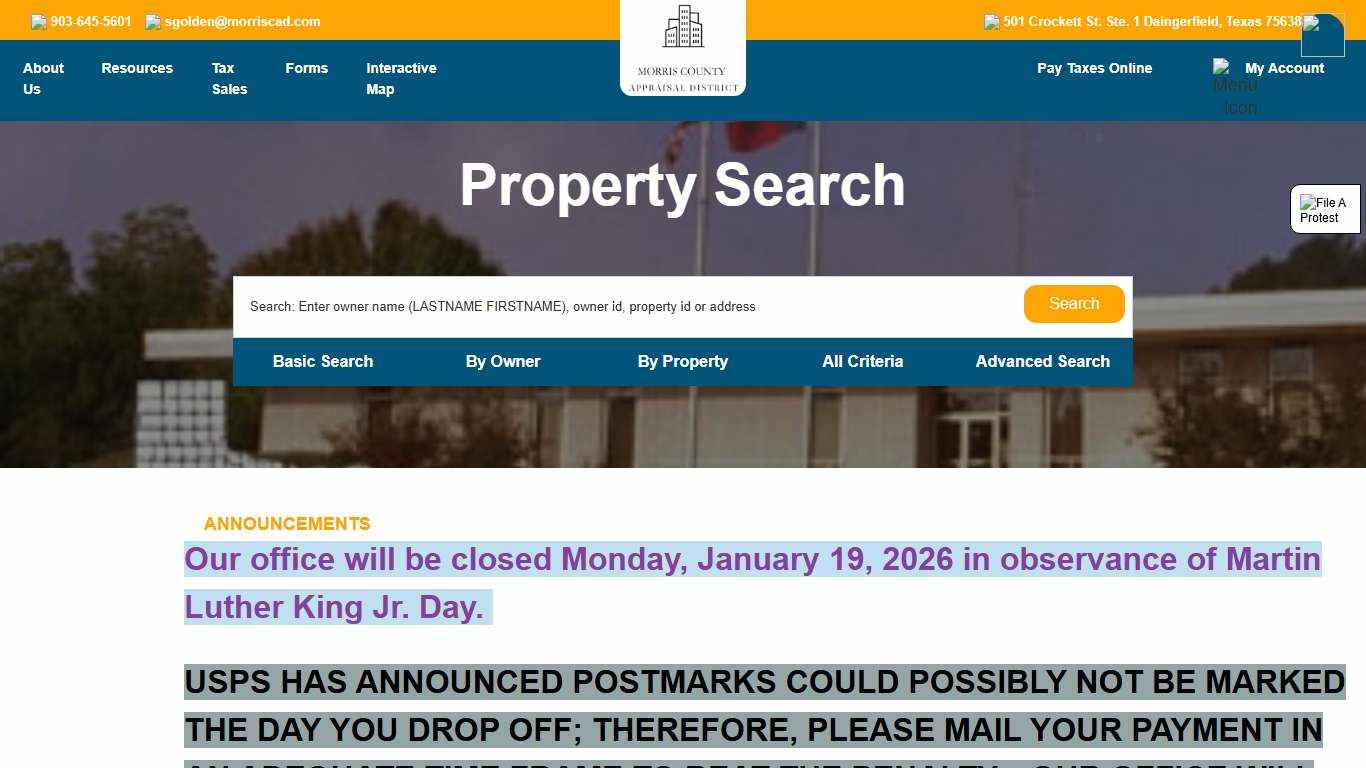

Morris CO Appraisal District

Our office will be closed Monday, January 19, 2026 in observance of Martin Luther King Jr. Day. USPS HAS ANNOUNCED POSTMARKS COULD POSSIBLY NOT BE MARKED THE DAY YOU DROP OFF; THEREFORE, PLEASE MAIL YOUR PAYMENT IN AN ADEQUATE TIME FRAME TO BEAT THE PENALTY.

https://morriscad.com/

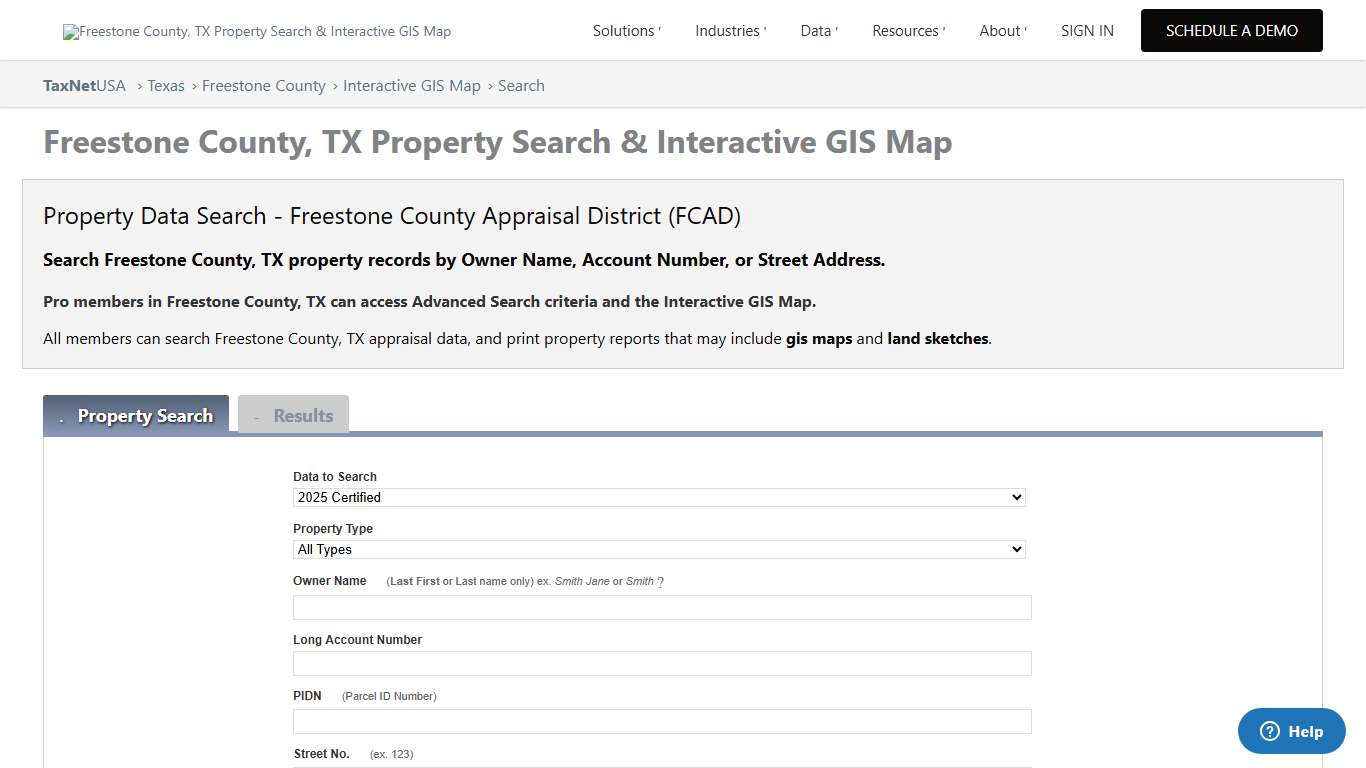

Limestone Tax > Home

LIMESTONE COUNTY TAX ROLL The Tax Roll includes information related to current and delinquent accounts collected by the Limestone County Tax Office. The file is created monthly, typically on the 15th, and is available on the website the following business day (excluding holidays).

https://www.limestonetexas-tax.com/